You can use debt consolidation to help free yourself from unwanted debt. Although it won’t solve all your financial problems, it will make it easier for you with just one simple payment each month to your creditors. If you see yourself overwhelmed and falling behind due to excessive debt every month, read on for some helpful tips about debt consolidation.

Getting a loan is a great way to pay debt off. Talk to the loan provider about interest rates you’re able to qualify for. Your car could be used for a loan if collateral is needed, then pay the money back to your creditors. Be sure to pay it all back as expected.

One way to pay off your debt is to borrow money. Talk to loan providers to figure out the rates that you qualify for. You can use a vehicle as a collateral for the loan and use the money you borrow to pay your creditors. You must be sure your loan is paid back on time.

Let your creditors know if you are working with credit counselors or a debt consolidation firm. They may make you an offer so you don’t have to go this route. That is critical, as they might not be aware you’re talking to other companies. Plus, they realize that you are attempting to responsibly manage your debts.

Home owners can refinance their mortgage to pay down their debts. Mortgage rates are low right now; it’s the right time to take advantage of this method. In addition, you may find that refinancing may even provide a lower mortgage payment than before.

Bankruptcy might be an option for you. Filing for chapter 7 or for 13 will leave your credit score in poor shape. That said, if you can’t pay off a consolidated loan, you’ll end up with bad credit anyway. Filing Bankruptcy is an option if your financial situation is too far gone to recover, but the decision is not to be taken lightly.

Call each of the creditors you owe money to in order to discuss a settlement. Once you have an overall total, talk to your bank about getting one loan to cover payment on all of your debt. Often creditors will accept a lower payout than the amount owed, if you pay in cash and pay the entire amount off. A lump sum settlement can increase your credit while lowering your overall debt.

If you have a credit card with a low interest rate, you may want to use it to pay off some of your debts. You can save a great deal on the interest, while also combining all your bills into one easy payment. If you consolidate things onto a card with an introductory low interest rate, then pay it off before that low rate expires.

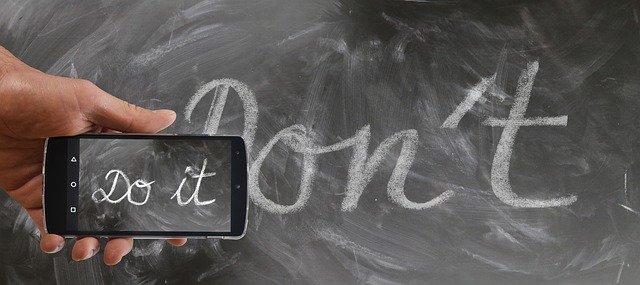

Don’t think of debt consolidation as an instant fix. If you don’t adjust your spending habits, you’re going to keep having problems with debt. Look for changes you can make in your finances to improve them in the future.

Find out more information about the interest rate for the debt consolidation. An interest rate that is fixed will help you budget your money and make your payments on time. You’ll know what you’re paying during the entirety of the life of the loan. Be aware of any sliding interest scales. You may end up paying higher interest rates than you were before.

Consider getting a loan from a friend or family member to help you get out of debt. This can be a risky method as you can ruin your relationship if the money is never repaid. This is the last opportunity to pay off debt, so do it only if you can pay it back.

Ask a friend or family member for a loan if you can’t get a loan anywhere else. Be sure you’re able to tell them when you’re able to pay things back and keep your promise. Keep in mind that not taking the responsibility to pay them back on time can ruin a relationship quickly because others will feel you can’t be trusted.

Instead of using debt consolidation loans, try paying off credit cards using the “snowball” tactic. Choose your card with the highest interest rate, and pay it off as quickly as possible. Next, take that extra money and use it towards the second highest card. It’s one of the best choices you can make.

Your consolidator should personalize their plans for you. If the people you work with aren’t interested in your financial situation and don’t ask questions on how you see yourself getting out of debt, then immediately look for another company. A debt counselor should work with you to come up with a personalized answer.

Payment Programs

When you’re filling out the paperwork for a debt consolidation loan, make sure you do it correctly. It is especially important to pay attention at this time. A single error can hold up the process indefinitely.

Before using a debt consolidation program, find out whether or not they offer individualized payment programs. For many of these companies they go with one standard approach for everyone, however, this might not work for you because your situation could be different. For best results, choose a consolidation company that offers custom tailored payment programs. They might cost more to start, but you will save over time.

When speaking with a debt consolidation company inquire about their fees. Every fee should have an explanation attached, and it should be written down in the contract. Make sure to ask how the loan will be divvied up between each of the creditors you have that need to be paid. The company handling your debt consolidation will prepare a payment schedule, and you should get a copy so you can see how much each creditor will be paid monthly.

You might want to consider debt consolidation if you are in a lot of debt and need to simplify your finances. Use the above information to help you get the most out of debt consolidation. Use what you’ve learned here, and put it to work to get out of your financial situation.

What is the address of your consolidator? Several states do not require a license to start a debt consolidating business. Therefore, you should ensure that the debt consolidation company you are considering is not located in these states. This information should be something you can easily come by.