Have you had difficult times because of bad credit? A lot of credit scores are going down during this economy. Fortunately, there are many things you can do to help improve your credit again, and these tips are an excellent place to start.

An imperfect credit rating can make financing a home even more difficult than normal. If possible, apply for an FHA loan; these loans are backed by the United States government. Even when the resources for making down payments or paying closing costs are lacking, FHA loans can help.

The first step in credit improvement is to build a commitment to adhere to it. You must be dedicated to making real changes to your money. Only buy the things that are absolutely need.

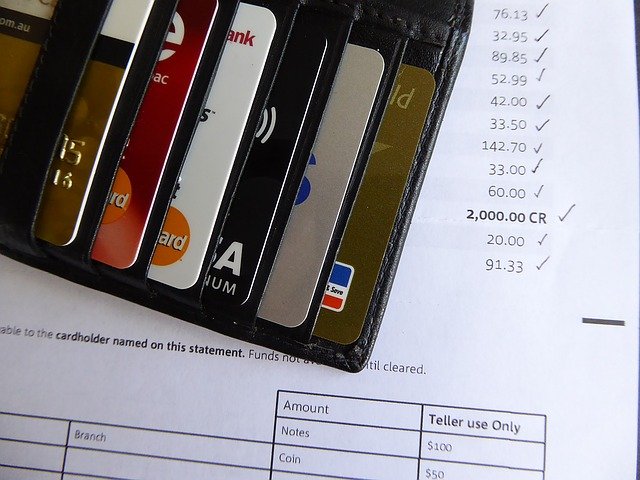

Try to get a secured credit card if you are not eligible for an unsecured card. This will help you fix your credit. These accounts are much easier to get as you will have to fund the new account ahead of time with a deposit to cover any purchases. Limited spending and regular payments can turn a new credit account into a valuable credit repair tool.

You may be able to reduce your interest rate by maintaining a high credit rating. This should make your payments easier and it will enable you to repay your debt much quicker.

You can easily get a mortgage if you have a high credit score. You can improve your credit by paying your mortgage on time. Owning your own home also improves your credit score in the form of having large assets to borrow against. Financial stability is important should you need a loan.

A great credit report means you are more likely to get financing for a home. Making mortgage payments in a timely manner helps raise your credit score. This will be beneficial when you end up needing to borrow funds.

If your debt includes large amounts for interest charges contact the debt collector and see whether you can pay the original debt and avoid some of the additional interest charges. Creditors are skirting a fine line of law when they try to charge you exorbitant interest rates. On the other hand, you’re likely bound by a contractual agreement to pay any interest charged by lenders. If you choose to bring a lawsuit against your creditors, use the high interest rates against them.

Opening an installment account will help you get a boost to your credit score. You can quickly improve your score by properly managing these accounts.

It is essential to pay all of your bills if you are looking to repair your credit. Not only must bills be paid, but they must also be paid in full and in a timely manner. After you have paid off some old bills, you will see an immediate improvement in your credit rating.

You must pay your bills off on time; this is very important. Your credit score will begin to increase immediately after you are past due.

One way to increase your credit score is to become a member at a credit union. Credit unions are normally located in communities and offer lower interest rates than national banks.

Make sure you research a credit counselor before you consider using. Many counselors are honest and helpful, but some are outright scams. Some are outright scams.

Anything on your credit report that you feel is inaccurate should be disputed. Compose a letter of dispute to every agency that reported errors, and include as much documentation as you can. Always send your dispute letters certified mail, so that you can get return confirmation. This will give you proof that the agency received your dispute paperwork.

Be wary of programs that can get you in legal trouble. There are less than honest entities that involve creating a fresh credit file. Do things like this can get you will not be able to avoid getting caught. You could end up owing a great deal of money or even facing jail if you are not careful.

Look through your credit card statement each month and make sure that it is correct. If you notice unwarranted fees or surcharges, contact the credit card company to avoid being reported for failure to pay.

Even if a charge held against you is legitimate, any small mistake in the item, such as an inaccurate date or amount, may let you have the whole thing taken off your credit report.

Many times you and your creditor can work together to come up with a prepayment plan. If so, be sure you get a written agreement stating the terms. This will protect you should the company change its policies. After you have paid off your debt, send proof of this to the major credit agencies.

If you wheel and deal and get a new payment plan, make sure you get the terms in writing. Once you finish making all your payments, you need to get a statement verifying this from the creditor and send it to each of the major credit bureaus.

To show that you are serious about improving your credit, start systematically lowering all of your account balances. You should first work on paying down the credit cards with the highest balance or interest rates. Creditors will see this action as a sign that you are responsible and educated.

Pay the balances on all credit cards as soon as you can. Pay down your cards that have the highest interest rates first. This will show future creditors you are responsible about your credit cards.

You will be able to keep up with your bills, and get a good credit score. Late payments are reported to all credit report companies and will greatly decrease your chances of being eligible for a loan.

This helps you maintain a proper credit status. Late payments are reported to all credit report companies and will greatly decrease your chances of getting loans or a home in the future.

Take the time to carefully go over all your credit card statements. It’s up to you to ensure that the charges on your bill are correct and that you haven’t been double charged, overcharged or charged for something you didn’t buy. You are the only person that is responsible for making sure the statements are error free.

Collection Agencies

Lenders won’t bother to look at those statements and therefor they are a waste of your time. It might actually make things worse by making the negative mark stand out.

Debt collection agencies can be the most stressful part in having bad credit crisis. This will stop the calls from collection agencies, it merely stops the threatening calls.

Avoid using credit cards. Pay for everything with cold, hard cash. If you ever use a credit card, be sure to pay it all in full.

Don’t believe the hype of lawyers or other offices that promise they can immediately fix your credit fixes.Because of the surge of credit issues out there, attorneys and scam artists have come up with ways to charge a high price for repair schemes that can be illegal and useless. Do a thorough background check on any lawyer before handing over any money.

One of the most nerve-racking aspects of being in debt, and having bad credit, is dealing with collection agencies. You can use a cease and desist letter to stop any harassment from collection agencies. Letters such as these prevent calls from collections agencies, but the consumer must still pay the debts under dispute.

If you have been frustrated and felt discouraged about your bad credit score, take these tips and use them to change that. There are a variety of ways to improve your credit rating.

Be aware that opening a new credit card account can affect your credit score in a negative way. Resist the urge to apply for credit cards while shopping at your favorite retailer, even if they offer tempting promotions. As soon as you open your new credit card, your credit score will drop.