Have you heard of debt consolidation? It’s likely that you have, but maybe you don’t understand its benefits. Anyone with multiple creditors can use debt consolidation to fix their situation. Picking your plan wisely is the key. This article will help you understand how these programs work and whether they offer a viable option for you.

When you are deciding with company to use for your debt consolidation, take a long-term view. You’ll want to find out if the company will be able to help you later on. Some provide services that help you avoid these situations later.

Do you hold a life insurance policy? Cashing out your policy can help you eliminate some of your debt. Speak with the insurance agent you have and see what you’d be able to get taken out against your policy. Sometimes you’re able to borrow some of what you’ve paid in.

Did you know that your life insurance can prove beneficial when considering how to pay your debt? If you really need to pay off some debt, consider cashing in the policy. Talk to a life insurance agent in order to discover how much money you could get from your policy. You can borrow back a portion of your investment to pay off your debt.

People often find solutions to help pay off debt faster just by simply talking to creditors. Many creditors want to help people become debt-free, so they’ll work with creditors. Let your credit card company know you cannot afford to make your payments, and they are likely to lower your monthly payment amount. During this time, however, your account will be closed to new charges.

Look into any credit card offers you get in the mail; it might be an excellent way of consolidating any debts you have. It can save you money on interest payments, and it’ll consolidate all those bills into just one thing to deal with! Once your debts are consolidated onto a low interest card, make sure you pay it all off before the interest rate changes to a much higher one.

Refinancing your home is one way to get a handle on your debt. With mortgage rates at their lowest, this is a good time to refinance and take care of your other loans. In addition, you may find that refinancing may even provide a lower mortgage payment than before.

Debt consolidation loans don’t affect credit scores. Therefore, this option can help pay off your debt with no additional penalty. This is an excellent strategy if you can afford to make all your payments on time.

You can get a loan that will help pay off many smaller debts. Some creditors will settle for substantially less if paid off right away. This will help your overall credit score, rather than harm it.

Read their privacy policy. It is important that you are aware of how they store your private information. Be sure encrypted files are used. This will help protect your identity should the computer system get hacked.

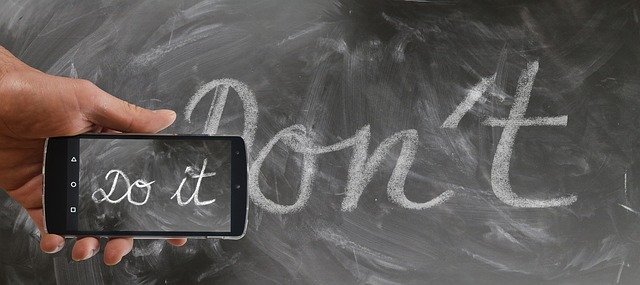

Get used to paying things in cash after a debt consolidation plan is in effect. It would be a shame to once again use your credit card for everything. Paying with credit is likely what got you into this mess. Pay with cash and you can’t overspend.

Why have you ended up in a financial hole? You must decide this prior to assuming any consolidation loans. If you’re unable to fix what caused it, treating your symptoms will not help. Determine what the problem was, fix it, and move forward with paying your debts.

Debt Consolidation

Debt management might be a good solution for you. Paying your debts off through debt management can help you find your way to freedom faster, without paying fees to consolidation companies. Just find a good firm to negotiate lower interest rates on your behalf.

A good debt consolidation firm will use personalized methods. If the staff at a debt consolidation agency seems eager for you to sign an agreement, it may be wise to look for a different agency. That approach is unlikely to be effective.

Be sure to understand the physical location of the debt consolidation company. Several states do not require a license to start a debt consolidating business. This is why you should be sure that the company isn’t headquartered in these places. You can find this information on the web.

Rather than a consolidation loan, try paying credit card balances with the “snowball” approach. Start with the credit card that has the highest rate and pay off its balance as quickly as possible. Then, apply your savings from that eliminated payment and put it against the next highest interest debt. It’s one of the best choices you can make.

You may be able to use the equity in your home to consolidate your debt. Take what you save from your mortgage and put it toward your other bills. This could be a wise choice to help you pay off multiple bills with high interest rates.

Debt consolidation can help you out of your debt mess, but you have to choose the right plan. Use this guide to help you figure out what your next steps must be. By doing this, you will make the best possible decisions for your financial situation.

Understand that you should pay back your debt consolidation loans in a maximum of five years, regardless of what the service tells you. Waiting longer can make you pay more interest and then it will be harder to pay off, so try sticking with a five year plan.