What debt consolidation information should I be aware of? How do I locate critical information that is written in plain English? How do I know what is accurate? If you have these questions, then keep reading to find out more.

If you are looking towards debt consolidation to take of your bills, never fully trust a company that says they are non-profit, or you run the risk of being over-charged for the service. Some predatory lenders use the nonprofit terminology to lure unsuspecting people in and then hit them with exorbitant interest rates. Inquire with the BBB and also speak with someone who understands these companies.

If you are looking towards debt consolidation to take of your bills, never fully trust a company that says they are non-profit, or you run the risk of being over-charged for the service. It could come as a big surprise when this seemingly innocent term results in an unfavorable consolidation deal for you. Call your local Better Business Bureau to check out the company.

If a credit card company has offered you a card with a low interest rate, consider using it to consolidate debt. This can save on interest and leave you with just one payment. After consolidating debt, the next step you must take is to pay all that debt off before your introductory rate happens to expire.

When seeking a consolidation loan, look for low, fixed rates. Without this, you won’t know what to pay every month and that can make things hard. A fixed rate loan will help put you in a better financial position.

Refinancing your home is one way to get a handle on your debt. Right now, mortgage rates are extremely low; therefore, it’s a great time to use this strategy to pay off your debts. In addition, your current mortgage payment could be less than what you had started with.

Credit Card

Understand that your credit score will not be affected by a loan for debt consolidation. A few debt reduction strategies do have adverse effects on your rating, but a debt consolidation loan is really just helping you lower your interest rate and minimize the total amount of bills you are paying. If you’re current and up to date with all your payments, this could be a very helpful process.

You may use a credit card with a low interest rate to consolidate smaller debts with higher rates of interest. This will reduce the number of payments you have and reduce the amount of interest you are paying. Once consolidating your debts using a credit card, you must be sure you pay the balance before the introductory term for the special interest rate expires.

Though most debt consolidation offers are legit and helpful, some are just scams. If a loan appears too good to be true, it probably is. Make sure that you ask the lender all of the questions that you may have. The lender should be able to provide you straight answers.

Debt consolidation companies offer help; however, there are certain companies that prey on debtors. If someone offers a deal too good to be true, do not trust them. Ask the lender a bunch of questions and be sure they’re answered prior to getting any kind of a contract signed.

Attempt to locate a solid consumer credit-counseling office near you. These offices are able to help you manage debt and combine all accounts into a single one. Engaging in credit counseling won’t harm your credit rating like working with consolidation firms sometimes will.

Looking into non-profit consumer credit counseling. Such an office can assist you in debt management and consolidation. Also, this will have little to no impact on your credit score.

If borrowing money poses a problem then perhaps a friend or family member could offer some assistance. If you do this, ensure you specify the amount you will need and the timeline that you can pay it back. Most importantly, you should commit to a set time to pay back the money and don’t break this commitment. Avoid ruining your relationship with a loved one at all costs.

See if the counselors at your debt consolidation agency are certified or not. Check with the NFCC to find reputable companies and counselors. This will allow you to know that you’re secure when you’re dealing with your debt consolidation.

See if your prospective company employs certified professionals. Check with the NFCC if you’d like to find counselors and companies that have a good reputation. This will help you to know you are working with professionals who can truly help with your financial situation.

Once you are in the midst of debt consolidation, start using cash for everything. You do not want to build up more debt! That’s exactly the habit that got you into your current situation. Pay with cash and you can’t overspend.

It is possible to borrow against your 401K if your debt situation is really bad. You borrow it from what you have paid into it. Make sure you do have all the details before borrowing, and know that it is a risky venture as it can take away your retirement funds.

If you need to eliminate debt and feel desperate, you might borrow from your own 401k. This gives you the power to borrow your own money instead of a banks. Make sure that you have a plan so that you don’t end up losing your retirement funds.

One method of debt consolidation is to take a loan from someone you know. Sadly, if you don’t repay it, you may destroy your relationship. Only do this if you are going to pay it back, since this might be your last chance.

Fill out the documents you receive from the debt consolidation company properly. This is when you’re going to have to pay close attention to things. They will cause delays and cost you money in the long run.

You could use a snowball payment plan as an alternative to debt consolidation. Find the card you have with the highest overall interest and get it paid off first. Go from there, and tackle another debt next. This represents one of your better options.

Be sure you’re able to contact the debt consolidation business when you’re needing to ask them something. You never know when a question will arise and you will need to get in touch with the company you choose. It is important to explore whether the customer service department of the company that you choose can meet these expectations.

Ask how much you will be charged by the debt consolidation service. They should have a listing of their services and the fees for each one. Just bear in mind that financial professionals like this have to perform a useful service before billing you or collecting fees from you. You should not need to pay for any fees to set up an account with this company.

With debt consolidation, you’re looking for an affordable, single payment to make each month. Most plans aim to pay off all of your debts in 5 years, but there are other time frame options as well. Then you will have a solid schedule of payments and an attainable goal in sight.

What fees come with your debt consolidator’s services? It’s important to make sure that each fee associated with a loan is fully spelled out in the contract. Find out how the payment will be divvied up between creditors. The consolidation firm should give you a schedule showing when each creditor will receive a payment.

Fine Print

Stick to a budget. A budget will help you learn how to budget your income effectively. By gaining a sense of renewed financial intelligence, your fortunes are sure to improve.

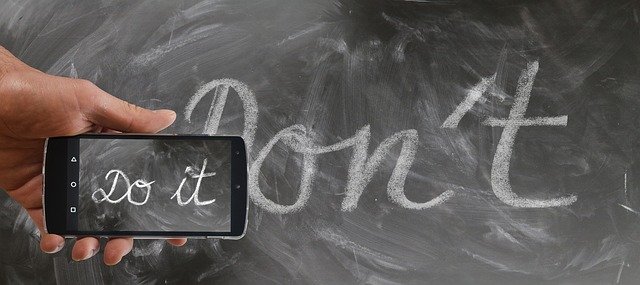

Debt consolidation loans do come with some fine print, so you’re going to have to inspect these terms and conditions. You’ll never be sure of what you’ll find in the fine print that can come up when you’re not expecting it. The loan is supposed to get you out of debt, not put you deeper in it!

Whenever you prepare a list of all your creditors, learn the details of them. The details should include the amount you owe, the payment amount, the date you payment is due and the interest rate. This information will prove helpful when you consolidate.

Average interest rate is an important calculation to consider. You should stack this rate against the offerings of the debt firms to ensure that you make a good choice. If you have a low interest rate, you might not need debt consolidation.

Prior to consolidating debts, make financial goals for the future. Debt consolidation services are a quick solution, but there are other options for those who have more time to fix their financial issues. If you have eliminate debt for something important, it’s probably best to consolidate your debt.

Do a long term calculation to help you understand how debt consolidation can help you save money. Write down what you currently owe and how much your interest is for each account. Comparing the number you obtain to the costs of the program can help you see that this is a useful strategy.

Don’t let anyone access your credit report unless you have decided to use their services. When a report is pulled, it is noted on your report. This is pointless if you don’t end up using that service. Little things, such as this, can reflect badly on your credit report and there is no reason for it.

The best way to begin the process of understanding how to get of debt is to get great advice. By utilizing great articles, such as this one, you can learn more on the subject. You should apply the tips from this article and learn more about debt consolidation so you can decide whether this is a good option for you or not.

If you want to get all of your debt consolidated, you may be able to borrow money from a family member. This may be simpler for paying back debt once a month. The interest rates will be lower than those you are paying already.