Mortgages are the tool that makes the dream of home-ownership possible. If you already have a home, you can refinance your current mortgage. Whatever your reasons may be for needing a mortgage, the following advice will improve your chances of getting a good rate and a quick approval.

It is important to get pre-approved for you home loan before you start looking at properties. Comparison shop to get an idea of your eligibility amount in order to figure out a price range. Once you figure this out, it will be fairly simple to calculate your monthly payments.

Before applying for a mortgage, have a look at your credit report to make sure everything is okay. 2013 ushered in much tougher credit standards for home loans, so it is essential to have the highest credit score possible to get to the best rates and terms.

It’s a wise decision to make sure you have all your financial paperwork ready to take to your first mortgage lending meeting. Having the necessary financial documents such as pay stubs, W2s and other requirements will help speed along the process. The lender wants to see all this material, so keep it nearby.

Do not go on a spending spree to celebrate the closing. A recheck of your credit at closing is normal, and lenders may think twice if you are going nuts with your credit card. Wait until you have closed on your mortgage before running out for furniture and other large expenses.

If you are underwater on your home, keep trying to refinance. HARP is allowing homeowners to refinance regardless of how bad their situation currently is. Lenders are now more likely to consider a Home Affordable Refinance Program loan. If the lender will not work with you, make sure you find someone else who will.

When you are denied, don’t give up. Instead, apply with a different lender. Each lender can set its own criteria for granting loans. This means that applying to more than one lender is a good idea.

When you are waiting to close on your mortgage, don’t decide you want to take a shopping trip. A recheck of your credit at closing is normal, and lenders may think twice if you are going nuts with your credit card. Any furniture buying, as well as any other expensive item or project, needs to wait until your mortgage contract is signed and a done deal.

Before you see a mortgage lender, gather up all of your financial papers. The lender will require you to show proof of your income, statements from the bank and any other documents about your assets. If you already have these together, the process will be smooth sailing.

Have your documents carefully collected and arranged when you apply for a loan. Most lenders will require basic financial documents. Gather your most recent tax returns, W-2 forms, monthly bank statements and your last two pay stubs. The mortgage process will run more quickly and more smoothly when your documents are all in order.

Do not allow a denial from the first company stop you from seeking a mortgage with someone else. Just because one lender has denied you, it doesn’t mean all lenders will. Keep shopping around until you have exhausted all of your possibilities. You might find a co-signer can help you get the mortgage that you need.

Define your terms before you apply for the mortgage, not only will this help show your lender you are equipped to handle the mortgage, but also for your own budget. This means you should have clear limits on what your monthly payments will be so you can base it on what you’re able to afford. Keep yourself out of financial trouble by buying a house you can afford.

Interest Rates

Get full disclosure, in writing, before signing for a refinanced mortgage. This should include all closing costs, and any fees you will be held responsible for. Most companies are truthful about all the costs involved, a few may conceal charges that you will not be aware of until it is too late.

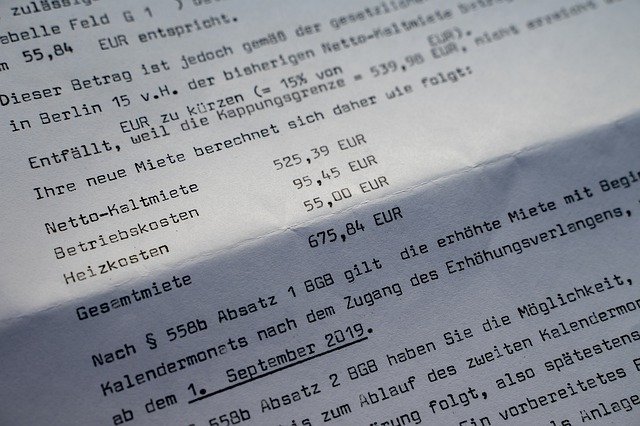

Pay attention to interest rates. A loan approval happens regardless of interest rates, but the rates determine the amount you must pay back. Know the rates and the amount it adds to your monthly payments, and the total cost of financing. If you don’t examine them in detail, you can end up making bigger payments.

Brokers would prefer to see small balances on a few different cards than one huge balance on a single line of credit. Avoid maxing out your credit cards. Getting your balances to 30 percent or less of the total available is even better.

Find out how to avoid shady mortgage lenders. A lot of lenders are legitimate, but some will try to bilk you for everything you have. Stay away from lenders that attempt to pressure you. Never sign if the rates appear too high or too low. Don’t use lenders who say that credit scores really do not matter. Also stay away from lenders that encourage you to lie when you fill out your application.

Research potential mortgage lenders before signing your bottom line. Do not only listen to the lender. Ask family and friends if they are aware of them. Look around the Internet. Talk to your local Better Business Bureau. This will help you to gather important information about your potential lender so you can make a smart buying decision.

A bit of education will help you get a better mortgage. Use these tips as you seek out a loan. That helps guarantee you get the sort of rate you want.

You should eliminate some of your credit cards prior to buying any home. Having a bunch of them, no matter the debt amount, may make you seem financially irresponsible. Having a low amount of credit cards can help you get a better interest rate.