Are you informed about debt consolidation? Maybe you’re someone who has acquired a substantial amount of debt with high interest, and right now you find yourself sinking. It’s probably time for you to take care of your finances and this is what debt consolidation can help you to achieve. Keep reading to learn all the options available.

When looking to consolidate your debt, do not assume that non-profit companies are trustworthy or that you won’t be charged much by them. Many predatory debt consolidators or predatory lenders will hide behind a nonprofit persona but may give you many expensive reasons to regret working with them. Always do your research on any company you are thinking of working with.

Are the counselors at your debt consolidation company fully certified? Are you going to be working with people who have an organization that certifies them? Do they have a legitimate reputation that you can count on? Researching the counselors can help you figure out if a company is right for you.

Speak with your creditors when you’re about to do business with a credit counselor or a debt consolidation business. Some creditors will work with you to lower your interest or adjust payments as necessary. Unless you tell them, they won’t know that you’re working with someone else. Work with a counselor to get your finances in control for the long run.

Debt Consolidation

Think about bankruptcy as an option. Filing for chapter 7 or for 13 will leave your credit score in poor shape. However, if you are missing payments and unable to pay off your debt, your credit may already be bad. You can decrease debts and work towards financial comfort when you file for bankruptcy.

Consider the long term effects of your debt consolidation decision. You need to deal with your debts today, but you need a company which will continue to work with you into the future. Choose a debt consolidation company that can help ease your present problems and help you to avoid getting in the same situation in the future

How is your interest rate calculated? Fixed interest rates are the best. The payments will remain the same throughout the loan. Watch out for any debt consolidation program with adjustable rates. Do not accept a debt consolidation loan if its terms include an adjustable interest rate.

Do not pick a debt consolidation just because they say they are “non-profit.” Being non-profit doesn’t mean that they are the best agency to help you with your needs. Instead, look up the company on the BBB to determine if you want to do business with them.

Negotiate with your creditors before trying debt consolidation. For instance, ask for a break on interest rates if you stop using it altogether. They might just give in to your demands!

Talk to creditors if you’re using a credit counselor or debt consolidation agency. Just this news alone might make them willing to make an independent deal with you. This will help to take the stress and tension away from your life. This will also help get your monetary situation under control.

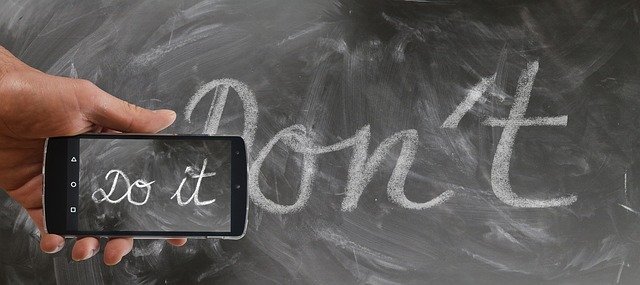

What is causing your debt? You must know the details to this before beginning debt consolidation. Just taking care of the symptoms will not work unless you also address the cause. Determine what the problem was, fix it, and move forward with paying your debts.

You should have a better idea of whether or not debt consolidation is a good choice for you. Will debt consolidation help you out? Get ready to put debt in its place! No longer are you going to be consumed; it’s time to live!

Find out the physical address of your debt consolidator. Some states don’t make a debt consolidation service become licensed before opening up. Make sure your state has regulations before picking a company near you. This should not be difficult information to find.